IWG – Update 15th August 2024, Price £1.7

Disclaimer: nothing is investment advice, do your own due diligence. I am often wrong. I am a shareholder of IWG.

Below are my incremental thoughts and updated forecasts post H1 results and connecting with management last week. Link to my prior deep dive write up on IWG is in this hyperlink.

High level:

Consensus has FY2024 and 2025 EBITDA of $550m and $600m respectively. H1 2024 annualised is already at $550m. Given the higher exit rate, particularly in managed and franchised (M&F), which has embedded growth from maturing new locations and pipeline of openings, IWG should start beating numbers from H2 onwards. I’m feeling increasingly confident there’s c.10% upside to street 2025 EBITDA forecasts. Earnings momentum, accelerating EBITDA growth (10% in 2024, rising to 20% in 2025), accelerating growth in the M&F revenues, combined with the launch of the sizeable buyback programme, is a rich set up for a stock trading on 6-7x 2025 FCF. I’m really struggling to find another stock in the market with this combination of value, growth (40%+ FCF / share growth) and business quality. The quicker the company starts retiring its shares at today’s depressed multiple, and the longer it can continue to do so, the better. My base case is that the stock re-rates progressively over time, from today’s 6-7x 2025 FCF to 15x (see section 10, scenario 3). This would be a 4-5 bagger over 4 years, i.e. over 50% compounded annual return. And if no re-rating materialises, the IRR should still be over 30% given the free cash flow per share growth, super charged by buybacks.

1) Working Capital / Leverage / Buybacks

The H1 results, quantified the one-off adjustment to working capital that the company had flagged at FY results. They are paying suppliers earlier, in exchange for better pricing. This passes the sniff test given the margin expansion being seen in owned & leased. The wrinkle here is, the working capital outflow doesnt reverse in H2, which I had previously assumed. The c.$90m delta to my 2024 FCF forecast, increases net debt and delays the timing of hitting the leverage target by about a quarter.

On a trailing 12-month basis the 1x leverage target should be reached with the publication of the Q1 trading update, so I’m now pencilling buybacks commencing in May 2025, instead of March 2025 with FY results. This delay is annoying but not thesis breaking. The good news is that I’m increasingly confident that the management team will not allow leverage to fall below 1x, and will return all FCF to shareholders, predominately via buybacks, unless of course there is an even more accretive use of capital (e.g. Wework acqusition). For modelling purposes, I assume that leverage is kept a 1x and that 100% of the capital return comes via buybacks. However, there is scope for the 1x leverage target to drift higher (perhaps to 1.5x) over time as the mix of cashflows from royalties (via M&F) and commissions (via Worka) grows and cash conversion improves.

The branded hotel companies (Marriott / IHG / Hilton / Hyatt), are credible comps for the capital light side of the business which is becoming a growing portion of cash generation. The hotels pay a “token” progressive dividend, but the lion share (almost 90% on average) of shareholder returns are delivered via buybacks, with leverage pegged at 2-3x. At 1.5x leverage, IWG’s cash conversion (levered FCF/EBITDA) and net debt / FCF should be 56% and 2.7x at 1.5x leverage in 2027, vs hotels today running at 50-57% and 3-5x. I think there’s a strong case that in 2027 or 2028, the leverage target will be increased to 1.5x, which would be an incremental $450-$500m of buybacks in the given year. That’s over 20% of today’s market cap, albeit I don’t bake this into my forecasts. Regardless, even if IWG keeps leverage pegged at 1x, the cumulative capital return for 2025 to 2028 is $2.1bn, which is 90% of today’s market cap.

2) IG bond issuance + convertible buyback

The company issued its first IG rated bond, due in June 2030, which was upsized to EUR575m. This was priced at 6.5% in Euros, translating into an effective interest rate of c.8% post accounting for the USD swap. The company also announced it has bought back and cancelled £160m of its £350m convertible bond. This is due in 2027, but has a put feature in Dec 2025, with a conversion strike of £4.58.

I expect the outstanding £190m to be repaid before the equity buyback starts, using FCF. So, the fully diluted share count is ALREADY declining, and should be 7% lower courtesy of the convert buyback, before factoring in equity buybacks once the 1x leverage target is hit. Its a smart move to cancel the converts as soon as possible, while the embedded equity option isnt captured in the convert pricing, given the distance to the strike price. Personally I’d prefer this done ASAP, using the RCF. The small incremental interest charge is worth paying to buyback converts before they price in the equity optionality, which wont be the case if the stock rises meaningfully, against the backdrop of earnings beats and a monster buyback coming into view. Despite pencilling a later equity buyback start date, my 2024 and 2025 fully diluted share count assumptions are 4-5% lower today than previously, due to the convert buyback that is underway.

3) Managed and Franchised (M&F)

Open rooms were 154k, pipeline of unopened rooms 151k, signings 73k in H1. While the openings pace is tracking a bit behind what I’m expecting, this is just a timing issue. What matters most is that signings are accelerating and the new M&F locations are filling up as expected, with RevPAR tracking in line with guidance. H1 signings were 146k rooms on annualised basis, +25% vs 2023 average (116k) vs my prior assumptions signings remained at 2023 levels. I now assume room signings are maintained at the higher H1 24 run rate. Management mentioned that a combination of moving growth responsibility to regional heads, and partners accessing cheaper financing (financing issues are the reason half of M&F prospects don’t make it to signing) provide the ingredients for signings to accelerate further from the H1 24 run rate, so arguably there’s upside to my signings assumptions.

The H1 investor presentation for the first time shared cohort data for newly opened M&F locations. This showed that at 12 months post opening RevPAR is averaging $200 and while the sample size for the 18-month cohort is very small, early signs are that the guidance of $250 at 18 months will be met or beaten. For context I model the 18-month cohorts at $255, growing to $290 at 28-months. This was the most important newly disclosed piece of information in the H1 update. The RevPAR trajectory of new managed partnerships, was the piece of the investment thesis, I was most nervous about. This data provides a lot of comfort on that front.

4) Owned & Leased (O&L)

Room count remains broadly stable, closures tracking at 4% annualised and revenue growth of open centre +5%. The contribution margin expansion was much greater than I was expecting, 260bps (75bps called out as one off) to 24%, with management confident they are on a path to recapture prior peaks. I now assume greater margin expansion, with 200bps in 2024, 150bps in 2024 and 100bps in 2026, before flatlining. Offsetting this, I assume a 1% decline in rooms / year vs flat before, with 4% closures offsetting 3% openings.

5) Worka

The platform upgrade is taking longer than expected to complete, and this is key to unlocking revenue growth, to ensure the platform is fully automated with a complete product suite. I’m pencilling in this being finalised by year end, with 5% growth in 2025 and beyond (vs 7% previously) to be conservative. The good news is that once this system upgrade is complete c.$15m of growth capex spend should drop away, which I hadn’t modelled previously. I haven’t heard anything re Worka spin or sale for some time and given the platform improvements are taking longer that expected, with revenue and profit growth recovery delayed to 2025, I wouldn’t expect anything on that front for a while. However, I’m do expect a Worka CMD to take place in the next 12 months, which hopefully will address its current status as a blackbox.

6) Insider Buying / Selling

Feedback I’ve heard is that as of the H1 update the overhang related to Deutsche Bank’s IWG placing of Mark Dixon’s stake has now cleared. I did notice that a director bought some stock post the H1 update.

7) US GAAP / US re-listing

US GAAP transition should be completed in H2, which should help the company screen better in the likes of Bloomberg / Koyfin etc, as lease accounting noise is removed. The bigger catalyst in my mind is around a US relisting, albeit I don’t expect any commentary on that in the near term.

8) Wework M&A

IWG management view, the company as the only player able to extract material synergies ($250m) and value from Wework, seeing the standalone entity as challenged, potentially needing another capital infusion down the line, so are happy to be patient and disciplined. Nonetheless, this is a very accretive and transformational deal in the making. IWG could leverage Wework’s strong brand, to super-charge growth in the managed and franchise division, and take an axe to Wework’s bloated cost base to extract material synergies, transforming its profitability and simultaneously remove their only scaled global competitor. Transformational M&A always has risks, but the potential prize here is material, if management can negotiate favourable terms.

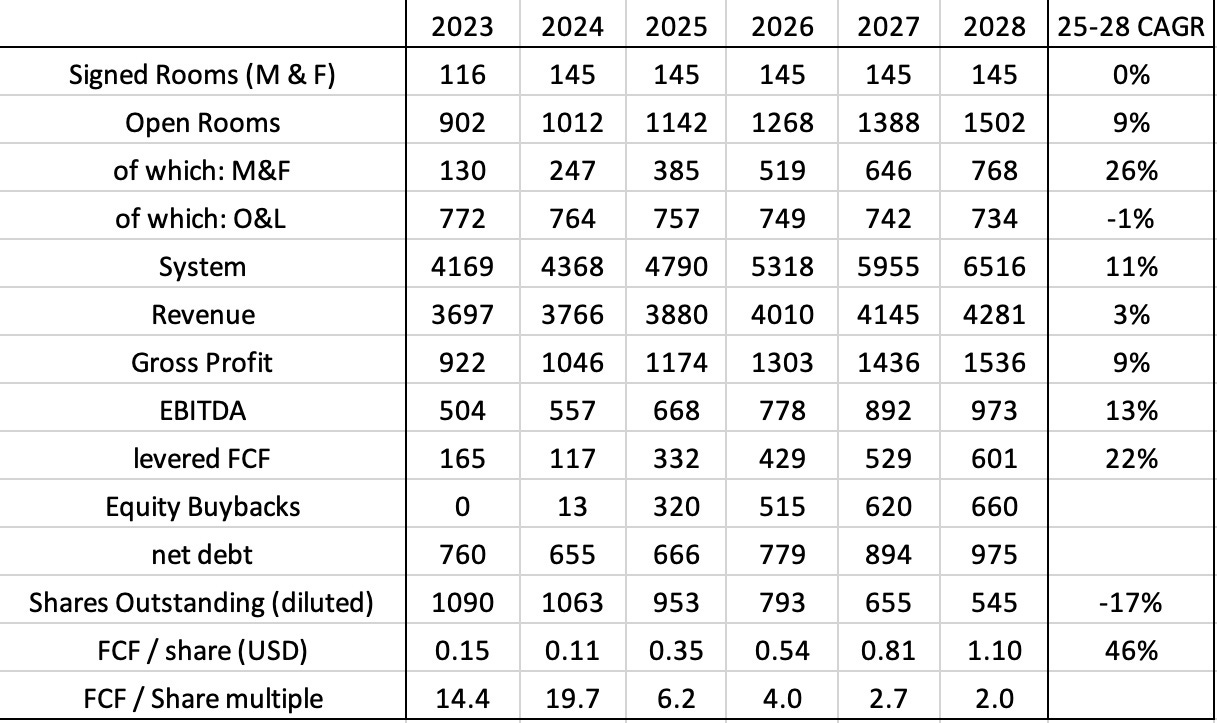

9) Updated Forecasts

Financials are in USD m , rooms are in thousands, share outstanding are fully diluted weighted average.

10) What’s the upside?

The above assumes, no re-rating materialises i.e., the stock trades at 6.2 x FCF / share in 2025 and beyond and therefore the company can buy back stock at that valuation. As a result, the 22% FCF CAGR (2025 to 2028) rises to 46% on a per share basis.

But what if the stock re-rates and the company can’t retire stock as cheaply as I model? Well, that is what I expect will happen (similar to Vistry). But this is a nice problem to have. Even at higher multiples the FCF / share growth is still eye watering (ie 30%+). Assuming buybacks are done at 8x FCF => 41% FCF / share CAGR 2025 to 2028…10x => 36% , 12x => 34%, 15x => 31%. Below are different scenarios I have run to frame the medium term upside in the stock.

Scenario 1: no re-rating

$1.1 FCF / share in 2028 x 6.2 FCF multiple = $6.82 = £5.3,

=> 210% upside over 4 years = 33% CAGR

Scenario 2: re-rates to 15x tomorrow

$0.77 FCF / share in 2028 x 15 = $11.55 = £9

=> 430% upside over 4 years = 52% CAGR

Scenario 3: progressive re-rating (10x in 2025 & 2026, 12x 2027, 15x 2028)

$0.83 FCF / share in 2028 x 15 = $12.5 = £9.7,

=> 470% upside over 4 years = 55% CAGR

Scenario 4: delayed re-rating (from 6.2x to 15x in 2028)

$1.05 FCF / share in 2028 x 15 = $15 = £11.6,

=> 580% upside over 4 years = 61% CAGR

My base case is that the stock re-rates progressively over time (scenario 3), from today’s 6-7x 2025 FCF to 15x. This would equate to a 4-5 bagger over 4 years or a 55% compounded annual return. What I love about the thesis is even if the stock never re-rates, the IRR is over 30% (scenario 1) given the strength of FCF per share growth once the buyback kicks in. The quicker the company starts retiring its shares at today’s depressed multiple, and the longer it can continue to do so, the better.

Feedback is welcome

Uzo

Uzo, its 3Q later. Buybacks have started earlier than anticipated but in a more moderated manner, Im forecasting $100-150m by year end. The $580-620 EBITDA target, perhaps they hit topline / beat by 5% = 620 - 650m. Debt now seems pinned at $700m.

Im getting to a FCF/Sh of $0.21 - 0.25c.

Unfortunately it would appear the failure rate between signups and opening is at ~50% or there is a capacity lag in supplying the design and service offerings to new spaces as openings for the past 2x Q's do not seem to be tracking signings unless Im missing something.

It would be great to hear your update / perspective.

Great analysis thank you